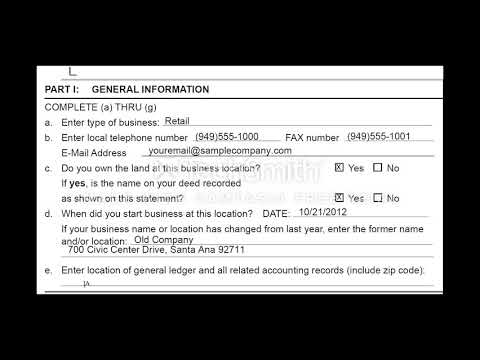

Hi, welcome to the first video tutorial on the 571-L Business Property Statement. California law requires an annual tax based on property as of 12:01 a.m. on January 1st each year. The 571-L form is used to declare all assessable business property in this county on that date. Failure to file a statement by the May 7th deadline will result in the assessment of the value of your property and the addition of a penalty equal to 10% of the assessed value. In these videos, we will demonstrate how to file your 571-L form and meet your filing obligation. This video will cover Part 1: General Information. First, you should find pre-printed information on the top of your form, including the name, mailing address, and location of your business property. If there are any errors or if information is missing, you can correct it by crossing it out and writing in the accurate information. For individuals and partnerships, enter the last name followed by the first name and middle initial. For corporations, enter the full corporate name. If the business operates under a DBA (Doing Business As) or a fictitious name, enter that name under the owner's name. Moving on to Part 1: General Information section, we will complete all the fields in this section. In Field A, enter the type of business you have, such as construction, retail, or restaurant. In Field B, provide the business's contact information, including telephone number, fax number, and email if available. Field C is regarding land ownership. Mark "Yes" if you own the land where the business property is located, or mark "No" if you do not own the land. If you own the land and marked "Yes," verify the official recorded name on your deed. If it matches the name on the 571-L form, check the...

Award-winning PDF software

886-l Form: What You Should Know

Fillable Form 886-H -H (rev. 3/6/2018) — Formal Form 886-H — H Formal (Rev. 3/6/2018) -Formal If your employer doesn't have an established policy on electronic submissions for any forms, you can fill this form using paper to send it. The form is not an electronic form. See Form 886-H for further information. You need to send supporting documentation — IRS Review the enclosed Form 886-L, Supporting Documentation. • Submit the documentation requested to show the amount of wages and withholding you listed on your tax Supporting Documents (Form 886-L) — Formal Form 886-H-HOH, Supporting. Complete the Response form at the end of this notice, and mail or fax it to us along with any returns, reviews, or other documents you have. Fillable form 886-l supporting documents — Fill Io Feb 18, 2025 — Fill Online, Printable, Fillable, B-1666.2 Fillable Form 886-H supporting documents for 2025 Form. Use Fill to complete blank online IRS PDF forms. Fillable Form 886-l supporting documents —Fill Io Aug 15, 2025 — Fill your Tax Online, Printable, Fillable, B-1666.2 Fillable Form 886-H supporting documents Form. Use Fill to complete blank online IRS PDF forms for free. Fillable Form 886-l supporting documents —Fill Io Filing fee — Formal Tax payer assistance program (TAP) Filing fee — Internal Revenue Service (IRS) A letter from you business official or tax preparer indicating that the amount of employment taxes withheld will be paid to your employers organization. Supporting documentation requested Fill the Form 886-B, Employer's Tax Payment Form, and send it with the amount of employment tax you deducted from the check, Supporting Documentation (Form 886-B) — Formal and you are ready to file. Fill the Form 886-B (Rev. 6/12/2018) — Formal, and send it with the amount of employment tax you deducted from the check, Supporting Documentation (Form 886-B) — Formal and you are ready to file. Fill the Form 886-B (Rev.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 11652, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 11652 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 11652 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 11652 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 886-l